How Animals Risk Security (LRP) Insurance Can Secure Your Animals Financial Investment

Livestock Threat Protection (LRP) insurance stands as a dependable guard versus the uncertain nature of the market, supplying a calculated method to securing your properties. By diving right into the intricacies of LRP insurance coverage and its complex advantages, animals producers can fortify their financial investments with a layer of safety that transcends market fluctuations.

Comprehending Animals Risk Security (LRP) Insurance Policy

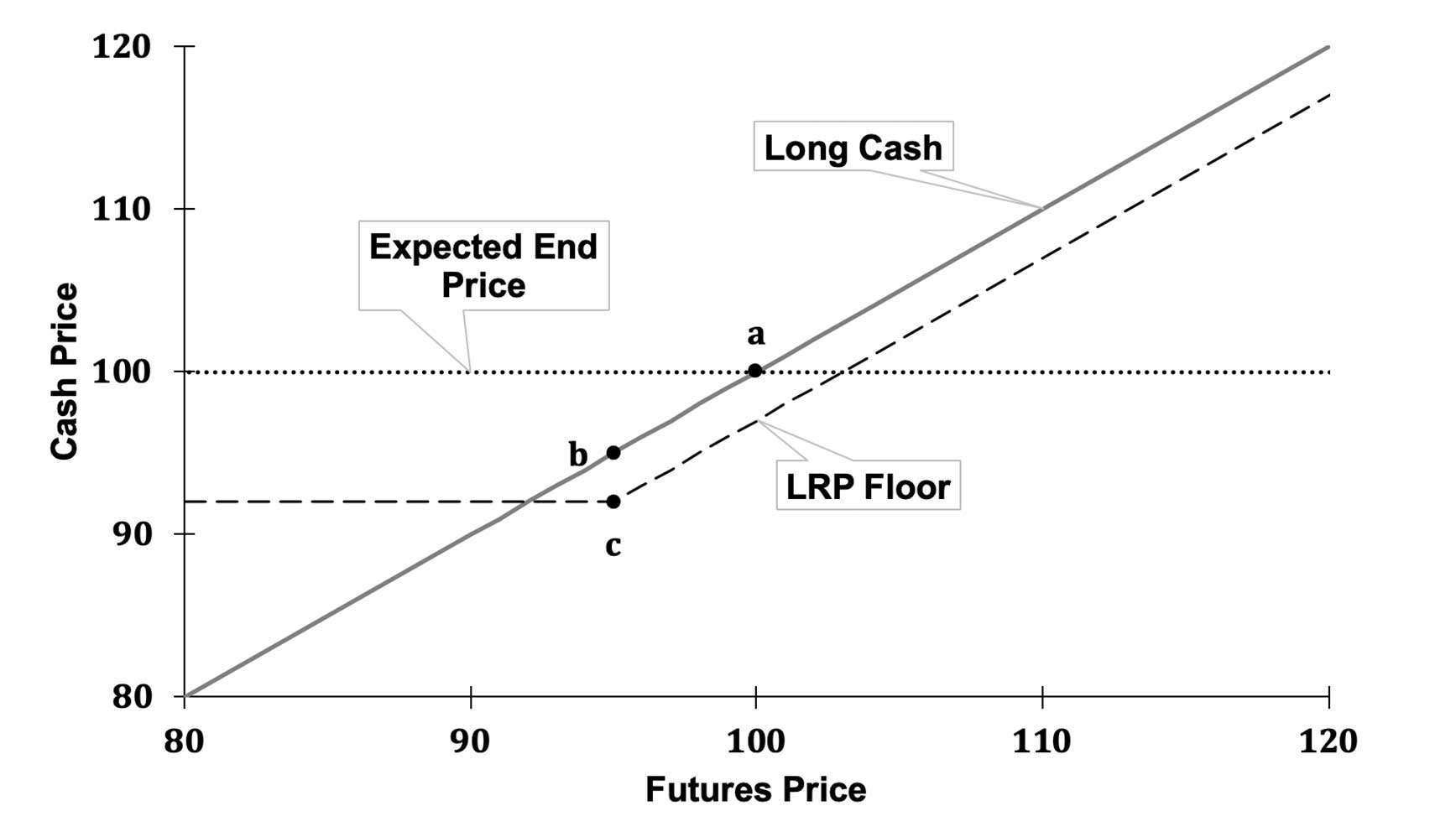

Understanding Livestock Threat Defense (LRP) Insurance is vital for livestock producers seeking to alleviate economic threats related to price fluctuations. LRP is a government subsidized insurance item made to safeguard manufacturers against a decrease in market value. By giving protection for market cost declines, LRP aids manufacturers secure a floor price for their animals, guaranteeing a minimum level of income no matter of market fluctuations.

One secret element of LRP is its flexibility, allowing manufacturers to customize insurance coverage degrees and plan sizes to fit their specific demands. Producers can select the number of head, weight array, coverage cost, and insurance coverage duration that align with their production goals and risk resistance. Comprehending these personalized options is critical for producers to properly manage their price danger exposure.

Additionally, LRP is offered for different livestock types, including cattle, swine, and lamb, making it a functional danger administration device for livestock manufacturers throughout different industries. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, manufacturers can make enlightened decisions to secure their financial investments and ensure financial security in the face of market unpredictabilities

Benefits of LRP Insurance for Animals Producers

Animals producers leveraging Livestock Threat Defense (LRP) Insurance policy acquire a calculated advantage in protecting their financial investments from cost volatility and safeguarding a secure economic footing amidst market uncertainties. One crucial benefit of LRP Insurance policy is rate security. By setting a floor on the rate of their animals, manufacturers can alleviate the threat of significant economic losses in case of market slumps. This allows them to intend their spending plans better and make notified choices regarding their procedures without the constant worry of cost variations.

Additionally, LRP Insurance gives producers with peace of mind. Knowing that their financial investments are safeguarded against unanticipated market modifications enables manufacturers to concentrate on other elements of their service, such as enhancing animal health and welfare or enhancing production processes. This assurance can lead to increased performance and profitability in the lengthy run, as producers can operate with even more self-confidence and security. Generally, the benefits of LRP Insurance coverage for livestock producers are substantial, providing an important tool for managing threat and making sure monetary protection in an uncertain market environment.

Just How LRP Insurance Mitigates Market Risks

Mitigating market threats, Animals Threat Security (LRP) Insurance policy supplies animals manufacturers with a reliable guard against price volatility and monetary uncertainties. By providing security against unanticipated rate drops, LRP Insurance coverage helps manufacturers protect their financial investments and keep financial stability despite market variations. This kind of insurance this link policy permits livestock producers to secure in a rate for their animals at the start of the plan duration, ensuring a minimum cost level despite market changes.

Actions to Secure Your Livestock Investment With LRP

In the realm of farming risk monitoring, implementing Animals Threat Defense (LRP) Insurance entails a strategic procedure to protect investments against market fluctuations and uncertainties. To secure your animals financial investment properly with LRP, the very first action is to analyze the specific risks your procedure faces, such as cost volatility or unexpected climate events. Recognizing these dangers permits you to figure out the insurance coverage degree needed to secure your financial investment adequately. Next off, it is crucial to study and select a trustworthy insurance policy supplier that provides LRP plans tailored to your animals and company needs. As soon as you have actually chosen a company, very carefully assess the plan terms, problems, and protection restrictions to guarantee they line up with your threat monitoring goals. In addition, on a regular basis keeping track of market patterns and readjusting your insurance coverage as needed can help maximize your protection versus possible losses. By following these actions vigilantly, you can improve the safety of your livestock investment and navigate market uncertainties with self-confidence.

Long-Term Financial Safety And Security With LRP Insurance Policy

Making sure enduring economic security with the use of Livestock Threat Defense (LRP) Insurance policy is a sensible long-term approach for agricultural manufacturers. By including LRP Insurance coverage right into their danger monitoring plans, farmers can guard their livestock financial investments against unexpected market changes and unfavorable occasions that can threaten their financial health with time.

One secret benefit of LRP Insurance coverage for long-term monetary safety is the satisfaction it offers. With a reputable insurance coverage plan in position, farmers can minimize the monetary dangers connected with volatile market conditions and unexpected losses as a result of factors such as illness outbreaks or all-natural catastrophes - Bagley Risk Management. This security allows producers to concentrate on the day-to-day procedures of their livestock service without constant stress over prospective economic troubles

Furthermore, LRP Insurance coverage provides a structured method to handling risk over the long-term. By establishing particular protection levels and choosing suitable endorsement durations, farmers can customize their insurance coverage plans to align with their financial goals and run the risk of resistance, guaranteeing a sustainable and safe future for their livestock operations. In verdict, buying LRP Insurance is a positive technique best site for farming producers to accomplish enduring economic protection and secure their livelihoods.

Conclusion

In verdict, Animals Threat Protection (LRP) Insurance is a beneficial device for animals manufacturers to mitigate market dangers and safeguard their investments. By understanding the advantages of LRP insurance policy and taking steps to apply it, manufacturers can attain lasting monetary safety and security for their procedures. LRP insurance policy supplies a safety web against cost fluctuations and guarantees a degree of security in an unforeseeable market environment. It is a smart choice for securing animals investments.